Lithium, in a nutshell, is a highly chemically reactive element not found on Earth in elemental form. It isn’t mined as lithium. But the commercial world uses the name of the element when talking about the array of lithium resources, supply and demand.

Lithium is the lightest metallic element. As a metal it has important though minor use as its numerous applications in refined mineral form and in a variety of chemical combinations are owed to its innate mineralogical, chemical, electrochemical, and physical properties. Lithium is mined as a silicate mineral or harvested from natural brines and then used in mineral form or converted into lithium chemicals or metal.

Standard applications use lithium in refined mineral form as a flux agent in glass, ceramics, and metallurgy; in chemical form in batteries, glass, ceramics, cement, grease, CO2 absorption, elastomers, pharmaceuticals, and agrochemicals; and as a metal in batteries, pharmaceuticals, and aluminium alloys.

Lithium-based energy storage devices are the fastest growing lithium application and the most promising rechargeable battery type available today. The recently emerged application of lithium chemicals in power tools and portable devices such as laptops and cellular phones created strong increase in demand. Looking forward, the next generation of hybrid and all electric vehicles are focussed on lithium-based battery solutions, as are stationary energy storage systems, and are forecast to further increase lithium demand starting 2013.

The USGS reported dramatic price increases of almost 50% for lithium carbonate between 2006 and 2008 reflecting average growth in demand of nearly 8% per annum in the 2000-2007 period. But, following the general trend, growth slowed dramatically in 2008 to just 2.4% and, even though consumption fell 15% and production collapsed 25% in 2009, US delivered lithium carbonate prices only reflected the market’s reduction with a 20% decrease in January 2010. Throughout, the Chinese market continued unabated, owing to internal fiscal stimulation, based mainly on imported raw materials. The market is expected to return to growth in 2010 with the first significant impact from the automotive industry expected from 2013.

Today the supply of lithium raw materials is dominated by a handful of producers in Chile, Argentina and Australia. New potential demand scenarios have created a rush on the part of junior mining companies and others, some partly supported by major automotive and electronics companies, to develop projects in traditional resource types as well as new ones. Today’s producers have also made clear their resources potential and capabilities for capacity increases.

Today, known global reserves and resources of lithium amount to 35 Mt (Evans 2010). Some 61% of this volume is found in high altitude continental brine aquifers of Argentina, Bolivia, Chile, and China and Tibet. About 34% occur in lithium mineral deposits mainly in Australia, Canada, USA, and Zimbabwe of which three quarters are crystalline hard rock deposits and a quarter are soft rock deposits. The 5% balance of this tonnage is contained in oilfield and geothermal brines in the western USA.

Today, known global reserves and resources of lithium amount to 35 Mt (Evans 2010). Some 61% of this volume is found in high altitude continental brine aquifers of Argentina, Bolivia, Chile, and China and Tibet. About 34% occur in lithium mineral deposits mainly in Australia, Canada, USA, and Zimbabwe of which three quarters are crystalline hard rock deposits and a quarter are soft rock deposits. The 5% balance of this tonnage is contained in oilfield and geothermal brines in the western USA.

The present global distribution of supply and demand is more restricted and unbalanced. Regions of high demand in Asia, Europe, and North America rely almost completely on imported lithium chemicals and minerals from Australia, South America, and Zimbabwe.

The most commercially important brine deposit today, containing 1.600 ppm lithium as lithium chloride, is the Salar de Atacama in Chile’s Region Two. It contributes to 50% of the world lithium production mainly in the form of lithium carbonate and is also a major source of potash recovered at an earlier stage in the brine concentration process. The Atacama conditions of high solar evaporation, very low humidity, low concentrations of magnesium and other impurities, and proximity to port are unique.

The most commercially important brine deposit today, containing 1.600 ppm lithium as lithium chloride, is the Salar de Atacama in Chile’s Region Two. It contributes to 50% of the world lithium production mainly in the form of lithium carbonate and is also a major source of potash recovered at an earlier stage in the brine concentration process. The Atacama conditions of high solar evaporation, very low humidity, low concentrations of magnesium and other impurities, and proximity to port are unique.

In contrast lithium-containing mineral deposits are, by far, more evenly distributed around the world.

Today, lithium minerals are mined exclusively from pegmatite hard rocks. Worldwide, numerous deposits, primarily containing spodumene and petalite, are being intensively explored with several at an advanced stage in Canada, Finland and Australia. Beneficiated lithium minerals are used in the mineral form and, today almost exclusively in China, for chemical conversion to lithium carbonate. Spodumene (8.0% Li2O), is the most common commercially exploited lithium mineral. Almost 50% of the spodumene mined in Australia today is converted to lithium carbonate in China. Less commercialized are zinnwaldite (3.4 Li2O), petalite (4.9% Li2O), lepidolite (4.1% Li2O), and amblygonite (10.0% Li2O). Advanced exploration is proving historically well known and large resources of hectorite (1.2% Li2O) in northwest Nevada, USA. Recently, the new lithium-boron mineral jadarite (7.3% Li2O) was discovered in sedimentary soft rock in Serbia where exploration of a massive resource is ongoing by mining major, Rio Tinto.

Lithium mineral concentrates consumed, e.g. in the glass industry or as a pre-product for the production of lithium carbonate, are traded at lithium contents of 5.00 wt% or 7.25 wt% Li2O depending upon the application. For regular ore deposits with head feed concentrations of 10-20% spodumene (8.0% Li2O) concentration factors of four to eight are required.

Lithium mineral concentrates consumed, e.g. in the glass industry or as a pre-product for the production of lithium carbonate, are traded at lithium contents of 5.00 wt% or 7.25 wt% Li2O depending upon the application. For regular ore deposits with head feed concentrations of 10-20% spodumene (8.0% Li2O) concentration factors of four to eight are required.

During conventional processing, crushing and grinding (comminution) is the first stage in the concentration process in order to liberate the lithium minerals from the rock matrix and to allow their separation and concentration in sequential downstream processes such as froth flotation or gravity separation. Pegmatite, the coarsely crystalline igneous host rock for spodumene and petalite, is hard and abrasive. As a consequence, comminution is energy intensive and accounts for up to 50% of the processing cost.

The concentration process yields a finely crystalline lithium mineral concentrate and a by-product mixture of fine minerals which is difficult to market and of low value. Potentially valuable minerals in the by-product mix are mostly not separated or recovered in the conventional processing concept. Consequently, the lithium mineral concentrate bears all the production cost.

In order to utilize the full value of the lithium bearing pegmatite, new concepts for the concentration of lithium minerals have been developed by ANZAPLAN.

An alternative concept for lithium minerals processing has been published by GPE and described in Minerals Engineering Journal. It exploits the characteristics of typical pegmatite host rocks – the coarse primary crystal size and the differences in color and morphology of the minerals within the ore.

An alternative concept for lithium minerals processing has been published by GPE and described in Minerals Engineering Journal. It exploits the characteristics of typical pegmatite host rocks – the coarse primary crystal size and the differences in color and morphology of the minerals within the ore.

By integrating two key technologies, selective fragmentation and optical sorting, further advantages can be achieved. Selective fragmentation breaks the ore more cleanly along natural crystal boundaries yielding larger size product whereas conventional grinding ignores crystal boundaries and yields finer size product. Liberation without destruction of the inherent large pegmatite crystalline material is key for efficient optical sorting.

Depending on the purity of the spodumene product, flotation may even be avoided reducing the consumption of chemicals and water and improving the overall economic viability of projects where wet separation techniques are not applicable.

Depending on the purity of the spodumene product, flotation may even be avoided reducing the consumption of chemicals and water and improving the overall economic viability of projects where wet separation techniques are not applicable.

Since fine grinding is avoided, highly valuable by-products can be separated during optical sorting, e.g. high purity quartz feedstock and low-iron potassium feldspar, and made available for further processing to meet commercial market specifications. Thus sustainability of the mining activity and the overall cost base is improved.

Besides laboratory scale equipment, ANZAPLAN provides a local test plant for the production of samples, allowing the customer to test the alternative processing concept on their specific pegmatite. The evaluation procedure includes ore processing and metallurgical tests up to concentrate roasting and crystallization of lithium carbonate following the acid or base digestion route.

GPE uses its in-house technical center and innovative machine manufacturer’s equipment for tailor-made process development and to provide samples for end user approval. The GPE bench scale and pilot plant processing facilities cover the full value chain of lithium minerals processing from the concentration of the lithium mineral to its conversion to, and refinement and precipitation of, lithium carbonate – including conventional and alternative processing routes.

GPE uses its in-house technical center and innovative machine manufacturer’s equipment for tailor-made process development and to provide samples for end user approval. The GPE bench scale and pilot plant processing facilities cover the full value chain of lithium minerals processing from the concentration of the lithium mineral to its conversion to, and refinement and precipitation of, lithium carbonate – including conventional and alternative processing routes.

Concentration of lithium minerals

Lithium mineral concentrates are produced for testing directly in ceramic or glass applications or as feed material for conversion to lithium chemicals. Special attention is also paid to potential by-products e.g. high purity quartz or feldspar concentrates which may create additional revenue.

The GPE technical center is well equipped and experienced to test and evaluate conventional steps of lithium minerals concentration:

- Comminution (Crushing and Grinding)

- Magnetic Separation

- Flotation

Besides the various conventional comminution technologies, selective fragmentation is available as an alternative to crushing and grinding techniques especially suitable for coarse grained lithium mineral bearing pegmatites. The combination of this technology with optical sorting can now be tested at GPE in comparison with conventional flow sheets, including a statistical evaluation of the liberation of lithium minerals by MLA.

Magnetic separation tests are performed by using wet or dry high gradient magnetic separators. For some pegmatites, tantalum may be concentrated in the magnetic fraction. In conventional processing flow sheets, lithium minerals are further concentrated by flotation e.g. with fatty acids.

Conversion of lithium minerals to carbonate

Different processing routes for the conversion of lithium minerals to carbonate may be performed at GPE. Hydrometallurgical test work includes leaching and purification to high grade lithium carbonate. Special attention is paid to the specific by-products which may be created during leaching and purification.

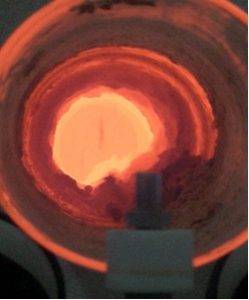

Static and rotary furnaces at GPE’s technical center are used to test the calcination properties of spodumene ore and to optimize the temperature treatment for the conversion of alpha to beta spodumene.

Besides acid treatment, alternative leaching routes of beta spodumene can be tested including pressure leaching which is required if the sodium carbonate route is chosen. Once an optimized route for the specific material is chosen the leaching process can be scaled up to allow the hydrometallurgical purification steps to be performed, e.g. separation of leached material and precipitation of interfering chemical elements.

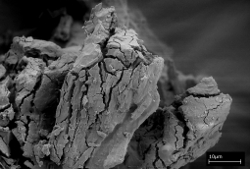

The introduction of an electrodynamic fragmentation process allows the selective liberation of pegmatite lithium minerals using high voltage pulses. The high selectivity of the fragmentation is achieved through shock waves generated in the rock. High tensile stress in the areas of the pegmatite mineral crystal boundaries, inclusions or composite interfaces, causes the material to predominantly break at these boundaries.

The introduction of an electrodynamic fragmentation process allows the selective liberation of pegmatite lithium minerals using high voltage pulses. The high selectivity of the fragmentation is achieved through shock waves generated in the rock. High tensile stress in the areas of the pegmatite mineral crystal boundaries, inclusions or composite interfaces, causes the material to predominantly break at these boundaries.

Laboratory and technical tests were carried out on a lithium pegmatite sample from Finland. Electrodynamic fragmentation provided selective liberation of spodumene, with only a low amount of fines. The microscopic analysis indicated a very high degree of liberation. Most of the minerals of the raw material sample were specifically fragmented to their primary crystal size. Within the fraction of 2.5-5.0 mm, about 80 wt% of the particles consist of one mineral phase, e.g. quartz, feldspar or spodumene.

Today, lithium chemicals are produced either from lithium bearing brines or minerals. Lithium enriched brines are mainly harvested and processed in Argentina and Chile where they are partly exploited as a by-product of potash production. Lithium minerals are mainly utilized in China. Almost 50% of spodumene produced in Australia by Talison Lithium is converted to lithium chemicals. Additional production capacity for spodumene conversion is expected.

Today, lithium chemicals are produced either from lithium bearing brines or minerals. Lithium enriched brines are mainly harvested and processed in Argentina and Chile where they are partly exploited as a by-product of potash production. Lithium minerals are mainly utilized in China. Almost 50% of spodumene produced in Australia by Talison Lithium is converted to lithium chemicals. Additional production capacity for spodumene conversion is expected.

In order to produce lithium chemicals for high tech devices from minerals, conversion to lithium carbonate or lithium hydroxide is required. Hydrometallurgical processes which may be applied to release lithium from minerals (spodumene, petalite, lepidolite, jadarite, hectorite, zinnwaldite, polylithionite or amblygonite) can be divided into the following major steps:

- Calcination at temperatures > 800 °C

- Leaching

- Purification

- Precipitation of lithium carbonate or –lithium hydroxide

In contrast to other lithium minerals, natural alpha-spodumene may be converted into beta-spodumene via calcination, offering specific leaching of lithium from the ore. Beta-spodumene may be digested in acid or base conditions. Whilst sulphate extraction is the standard treatment new developments in European projects favor base extraction technologies. Subsequent to either acid or base leaching step, technical grade chemicals are produced in GPE’s own test center. Further hydrometallurgical purification improves quality with purities in excess of 99% lithium carbonate. Thereafter, conversion to lithium carbonate or lithium hydroxide – the base materials for most derivative lithium chemical production – is performed.

When Li bearing minerals such as zinnwaldite or polylithionite are to be used for production of lithium chemicals a decomposition step is required. For this purpose the minerals are mixed with alkali compounds, alkaline earth compounds (mainly sulfates) or mixtures thereof and are decomposed at temperatures > 800 °C. The roasted product is then ground and leached with water to bring lithium into solution. Subsequently the leaching liquor is purified and lithium is precipitated as carbonate. If necessary, purity of the precipitated lithium carbonate can be upgraded by recystallization.

Besides laboratory scale equipment, GPE operates a local test plant for the production of samples, covering the full value chain, from the concentration of the lithium mineral to the refinement and precipitation of lithium carbonate.

Additionally GPE offers to develop concepts for creating marketable products from side products that are gathered during physical or chemical processing. This creates additional value and minimizes waste streams.

Read More >>

- 75 Edridge Rd, Croydon, Greater London, CR0 1EJ

- 0745-230-4089

- Mon - Fri: 9:00 - 18:00